Flash Note

Q3 2022: a quarter of active stewardship illustrated

- Published

-

Length

2 minute(s) read

-

24engagements held

-

98%meetings voted

-

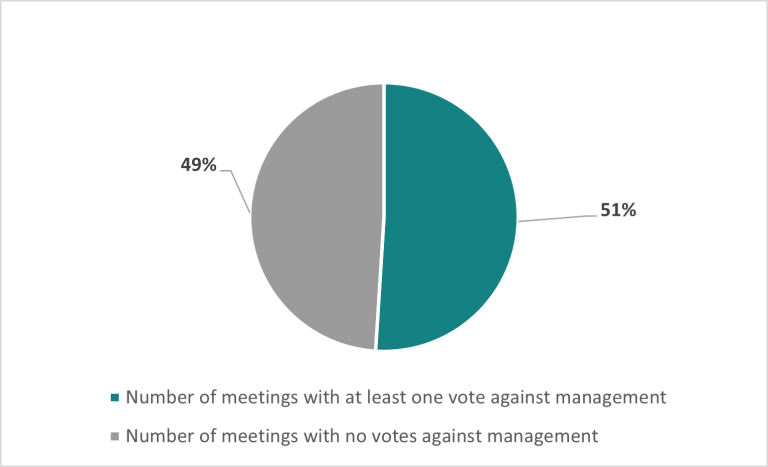

51%of meetings where Carmignac voted against management at least once

-

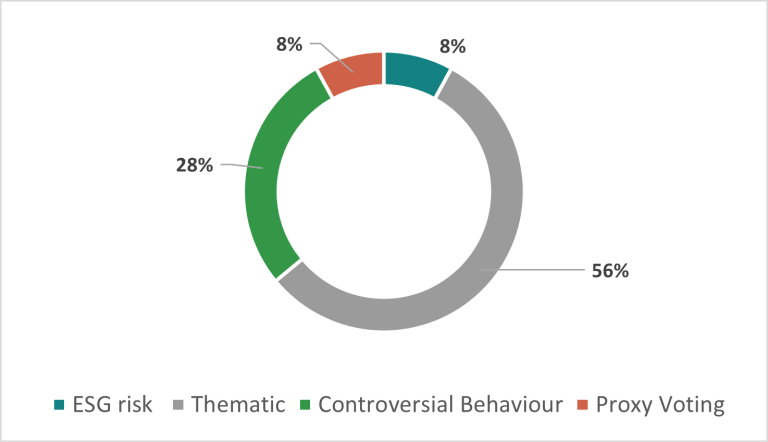

Carmignac held 24 engagements in the second quarter of 2022: -

Q3 2022 engagement activity

-

In Q3 2022, Carmignac voted against the management of our investee companies at least once at 51% of meetings voted:

-

Meetings voted for/ against management

Dabur India

Sector: Consumer staples

Region: South Asia

The company is held in a number of Carmignac’s equity funds1 .

1As at the date of the engagement reported below (September 2022) and the date of publication of this case study (December 2022). Equity funds are Carmignac Emergents, Carmignac Portfolio Emergents, Carmignac Portfolio Emerging Patrimoine, FP Carmignac Emerging Markets, FP Carmignac Emerging Patrimoine

2 Resolutions 8 and 9 - Approve Reappointment and Remuneration of Pritam Das Narang as Whole Time Director Designated as Group Director - Corporate Affairs; Approve Revision in the Remuneration of Mohit Malhotra as Whole Time Director and CEO

3Resolution 4 - Reelect Saket Burman as Director

4As per ISS’ definition of independence

5In line with our voting guidelines. Please refer to our Voting Policy for more information: https://carmidoc.carmignac.com/SRIVP_INT_en.pdf

6The proprietary ESG system START combines and aggregates market leading data providers ESG indicators. Given the lack of standardisation and reporting of some ESG indicators by public companies, not all relevant indicators can be taken into consideration. START provides a centralised system whereby Carmignac’s proprietary analysis and insights related to each company are expressed, irrespective of the aggregated external data should it be incomplete. For more information, please consult our ESG Integration Policy: https://carmidoc.carmignac.com/SRIIP_INT_en.pdf