Seeking diversification

Integrating alternative strategies not only offers a compelling way to incorporate defensive features into a core portfolio over the long term, but also serves as a great diversification tool to ensure smoother sailing.

A new standard

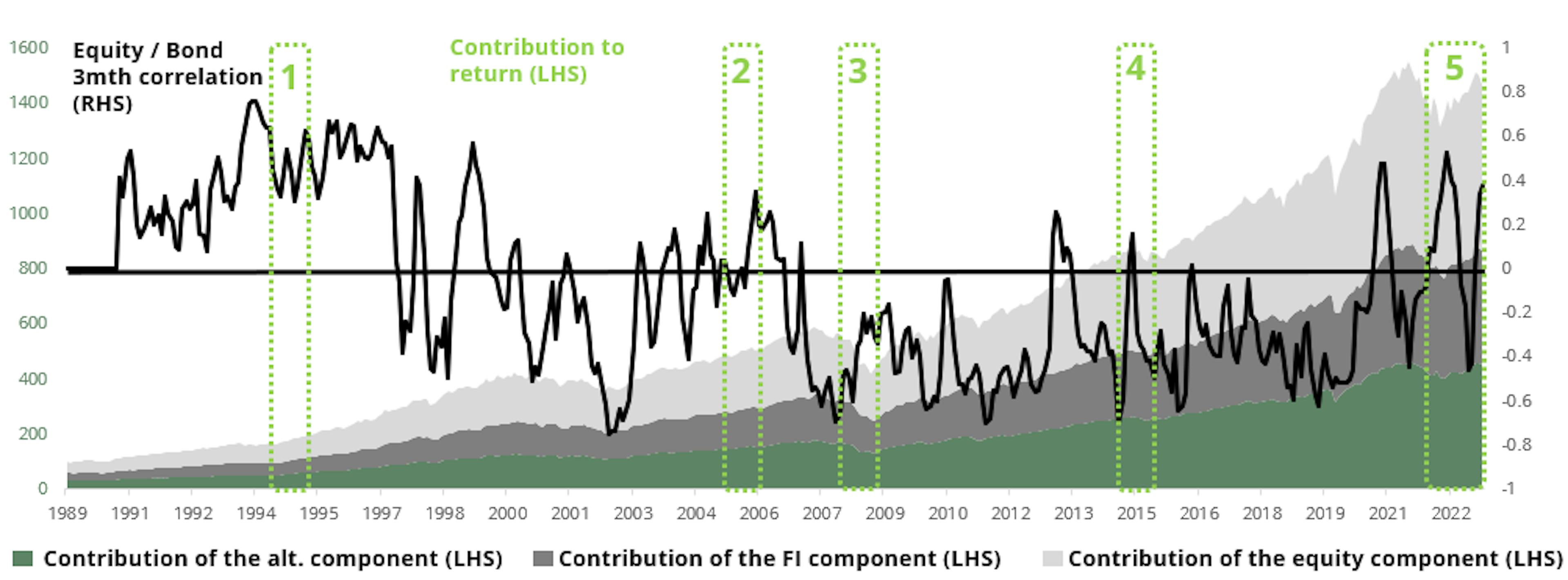

For most of the past 15 years, traditional investors have enjoyed a period where the fixed income and equity components of their diversified portfolios were a perfect match, as they were negatively correlated (see black line in Chart 1 below). More often than not, when the economy slowed down, equities incurred losses while bonds on the other hand cushioned the fall in equity prices as yields trended lower. And as such, the aggregate losses of a balanced portfolio were somewhat controlled.

But the environment has somewhat changed since the pandemic and the return of both inflation and inflation uncertainty. And we’ve been witnessing a greater number of periods where equities and bonds incur losses in tandem. Such a change in the traditional behaviour and relationship between equities and bonds will have some (dire) consequences for investors.

The first one pertains to how they can better integrate defensive features into portfolio construction

Indeed investors must deal with quite a conundrum. If they want to reduce the cyclicality of their balanced portfolio, they tend to increase the proportion of bonds in the portfolio. And by doing so they are increasing the sensitivity of the portfolio to inflation. And hence, as inflation (potentially) surprises to the upside, fixed income instruments may temporarily lose their diversification features; adding a layer of complexity in portfolio construction.

The second one pertains to how they can seek to benefit from more stable returns

And yet this is not only bad news

The unprecedented hiking cycle in most of the world, the uncertainty surrounding inflation, and the return of price discovery mechanisms as a price insensitive buyer (central banks) vanishes have led to an increase in the cost of capital globally. This in turn has had several (fortunate) consequences for investors.

The most obvious one lies in the higher bond yields, which should lead to more attractive returns down the line, provided defaults are avoided or bonds are purchased at prices that already factor in a particularly adverse scenario.

The second one is that along with the increase in uncertainty comes an increase in dispersion. Even more so as uncertainty tends to come hand in hand with fear, a sentiment that’s aggravated during periods when safe havens are hard to find. An increased level of dispersion provides fertile ground for stock (and bond) picking, which is the bread and butter of long and short strategies. A particularly valuable feature indeed, since dispersion can remain high in both bull and bear markets, and as such provides for an additional and differentiated performance driver from market direction.

As per the above, adding alternatives to a core portfolio can help to provide a more defensive tilt but also to enhance returns in inflationary times. Lowering dependency on market direction in such periods is more than welcome, as we’ve been reminded again over the past weeks, months, and quarters.

Concretely, what would it look like?

For the sake of simulating the impact of integrating alternative strategies, we conducted a simple, yet transparent exercise on the basis of historical long-term data (going back to the early 1990s) on both traditional and alternative markets and segments.

| Return | 9.9% | 5.1% | 3.1% | 10.4% | 7.2% | 6.8% |

| Average 3Y Vol. | 14.0% | 2.9% | 0.2% | 8.4% | 3.6% | 5.2% |

| Max.DD | -53% | -14% | 0% | -31% | -11% | -28% |

| Beta to equities | 1.0 | 0.03 | 0.0 | 0.47 | 0.14 | 0.21 |

Once we have the main risk/return characteristics of those individual asset classes, we can calculate the historical long-term returns of a core portfolio and of the same core portfolio to which alternative strategies have been added (at 10%, 20% and 30% of the allocation).

| Return | 8.0% | 8.1% | 8.0% | 8.2% | 8.2% |

| Average 3Y Vol. | 9.6% | 6.0% | 9.2% | 8.9% | 8.5% |

| Max.DD | -37% | -23% | -35% | -33% | -31% |

| Beta to equities | 0.60 | 0.28 | 0.58 | 0.55 | 0.52 |

As the above table shows, we can see that integrating some alternative strategies into a core balanced portfolio is not disadvantageous to performance over the long term, and that in fact it actually allows for a more resilient return profile (lower volatility and less severe drawdowns). Given the liquidity constraints and the breadth of underlying markets, over-allocating to liquid alternative strategies is not a panacea, but allocating to some alternative strategies has proven to be beneficial.

And beyond the long-term picture, it’s interesting to note that when looking more specifically at challenging times and periods of positive correlation between the prices of equities and bonds when both are moving to the downside, alternative strategies have proven to be particularly beneficial. Likewise for beta to equity markets, which tends to fall for alternative strategies when the beta to fixed income markets picks up – i.e. the strategies are particularly valuable at moments where they are most needed – as per Chart 1 below.

CHART 1: PERFORMANCE OF A 60/40 PORTFOLIO WITH A 30% ALLOCATION TO ALTERNATIVES AGAINST THE CORRELATION OF EQUITIES AND BONDS

As can be seen in the chart, allocating to alternatives provides a stable base for a diversified portfolio to gradually build returns over time. Looking more specifically at certain periods – numbered 1, 2, 3, 4 and 5 – that were particularly challenging:

PERIOD 1 (H1 1994): This year resembled the past two years, as it was (until then) dubbed the great bond massacre. The period saw both equity and fixed income markets post negative returns – a 60/40 portfolio was down by 4% with losses on both legs. Contrasting the returns of alternative strategies with L/S equities limited the losses to close to nil, as did credit, while M&A strategies were up 4% over the period. And more generally, the early 1990s to 2000s was a period when the equity/bond correlation was positive, and saw strong outperformance by alternative strategies compared to traditional strategies.

PERIOD 2 (H1 2005): This period saw meagre returns as both equities and bonds delivered negative real returns (less than 1%, vs more than 1.5% for cash over), as the pace of the global economy proved resilient in the face of upward oil prices. But all building blocks of alternative strategies outperformed cash rates, illustrating the benefits of capturing alpha and alternative risk premiums as markets move sideways.

PERIOD 3 (H1 2008): While cash was king during this mother of all crises, the magnitude of the sell-off in equities and spread assets meant that a 60/40 portfolio suffered some significant losses. And, thanks to their defensive nature, alternatives embedded some welcome resilience as markets sold off (both L/S equities and alternative credit cushioned 30% of the fall in their corresponding underlying markets). One data point of note, merger & arbitrage strategies proved particularly beneficial, posting a relatively modest negative return of - 5%.

PERIOD 4 (2015): The spring of 2015 proved to be another challenging episode for 60/40 portfolios, with prices of both core bonds and risk assets falling in tandem – notably in Europe as concerns over Greek politics and the Bund tantrum sent both nominal and real yields up. The virtue of diversification worked wonders as all alternative-strategy building blocks delivered solid absolute returns ranging from 2% to 4%.

PERIOD 5 (2022): In a year that will be remembered as the great bond massacre, where the drawdown in bond markets matched that of equities, alternative strategies proved to be particularly beneficial for their diversification and defensive features, at a time when the prices of bonds and equities both dropped by double digits. Indeed, L/S equities and alternative credit cushioned 50% of the fall in their underlying markets and merger & arbitrage strategies delivered positive returns, even outperforming cash benchmark.

And on a forward-looking note, the defensive features of liquid alternatives are also likely to be appreciated should there be more challenging times ahead. The prospects of a recession are mounting as tighter financial conditions take their toll while risk assets appear increasingly nervous. In fact, liquid alternatives would allow for return diversification if growth is resilient, and/or defensiveness should the economy fall off a cliff.

Such resilient characteristics (for the combination of a core balanced portfolio and an allocation to alternative strategies) doesn’t mean that attractive returns will be sacrificed at the altar of downside protection. Indeed, absolute returns remain far in excess of cash and, when adjusting absolute returns for risks (whether from volatility or maximum drawdown), such a portfolio would in fact fare better than a traditional one.

Integrating alternative strategies not only offers a compelling way to incorporate defensive features into a core portfolio over the long term, but also serves as a great diversification tool to ensure smoother sailing, especially in turbulent market conditions. Indeed, diversification provides a particularly forceful way to address uncertainty around inflation and hence correlation risk.

Carmignac's Alternative Range

Providing investors an attractive and uncorrelated source of returns to traditional marketsFind out moreRelated articles

Carmignac Merger Arbitrage: Letter from the Portfolio Managers

![[Main Media] [Funds Focus] Bridge](https://carmignac.imgix.net/uploads/article/0001/02/26ad7f7eb70cc9f1137127c5b230d8042189f9e1.jpeg?auto=format%2Ccompress&fit=fill&w=3840)

Carmignac Absolute Return Europe: Letter from the Fund Managers

Carmignac Portfolio Long Short European Equities: Letter from the Fund Manager

MARKETING COMMUNICATION.

Please refer to the KID/KIID/prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

Source: Carmignac, 29/12/2023. The information mentioned above may not be reproduced, in whole or in part, without prior authorisation from the management company. It does not constitute a subscription offer, nor does it constitute investment advice. The information may be partial information, and may be modified without prior notice. Past performance is not necessarily indicative of future performance. Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. Investors have access to a summary of their rights in English on the following link (paragraph 6): https://www.carmignac.com/en_US/article-page/regulatory-information-1788.

In the United Kingdom, this article was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd and is being distributed in the UK by Carmignac Gestion Luxembourg. The Management Company can cease promotion in your country anytime.

In Belgium: This communication is published by Carmignac Gestion S.A., a portfolio management company approved by the Autorité des Marchés Financiers (AMF) in France, and its Luxembourg subsidiary Carmignac Gestion Luxembourg, S.A., an investment fund management company approved by the Commission de Surveillance du Secteur Financier (CSSF). “Carmignac” is a registered trademark. “Investing in your Interest” is a slogan associated with the Carmignac trademark. This document does not constitute advice on any investment or arbitrage of transferable securities or any other asset management or investment product or service. The information and opinions contained in this document do not take into account investors’ specific individual circumstances and must never be interpreted as legal, tax or investment advice. The information contained in this document may be partial and could be changed without notice. This document may not be reproduced in whole or in part without prior authorisation. The risks and fees are described in the KID (Key Information Document). The prospectus, KID, the net asset-values and the latest (semi-) annual management report may be obtained, free of charge, in French or in Dutch, from the management company (tel. +352 46 70 60 1) or by consulting its website or www.fundinfo.com. These materials may also be obtained from Caceis Belgium S.A., the financial service provider in Belgium, at the following address: avenue du port, 86c b320, B-1000 Brussels. Any complaint may be referred to complaints@carmignac.com or CARMIGNAC GESTION - Compliance and Internal Controls - 24 place Vendôme Paris France or on the website www.ombudsfin.be. The Management Company can cease promotion in your country anytime. Investors have access to a summary of their rights in French or Dutch on the following links at section 6 entitled "summary of investor rights": https://www.carmignac.be/fr_BE/article-page/informations-reglementaires-2244 or https://www.carmignac.be/nl_BE/article-page/wettelijke-informatie-3542.

![[Management Team] [Author] Thozet Kevin](https://carmignac.imgix.net/uploads/NextImage/0001/18/%5BManagement-Team%5D-Thozet-Kevi.png?auto=format%2Ccompress&fit=fill&w=3840)