Carmignac Portfolio Emergents: Letter from the Fund Managers

Carmignac Portfolio Emergents1 gained 3.00% in the third quarter of 2023, against a 0.03% rise in its reference indicator3. This brings the fund’s year-to-date return to 7.10%, versus 2.61% for its reference indicator. The third quarter was marked by turmoil in the bond market that pushed US Treasury yields up to levels last seen in 2007. That made the good performance of emerging-market stocks a pleasant surprise, especially when compared to the Bernanke taper tantrum in 2013, when US yields surged and triggered a crisis in all emerging-market asset classes. However, it’s worth bearing in mind that back in 2013, emerging-market currencies and spreads were at historically low levels – which isn’t the case today, after a decade of emerging-market underperformance.

Overview of q3 2023

Our fund’s solid Q3 return can be attributed to our judicious stock-picking in China. Our dedicated Chinese specialists managed to identify an interesting investment opportunity: Miniso, a household and consumer goods retailer. Miniso is a remarkable success story in China’s entrepreneurial landscape. The company started by setting up a low-cost production base with a limited product range. Then, thanks to the efficient management of its entire production chain, the firm was able to expand its product range to include kitchenware, toys, cosmetics, consumer electronics, and more. Miniso has also been effective at expanding internationally; today nearly 40% of its 5,545 stores are outside China. What’s more, the company’s business model meets our investment process requirements. For instance, it’s not capital intensive since the firm neither owns its storefront property nor requires large amounts of working capital. As a result, Miniso has a solid balance sheet with almost $1 billion in net cash & cash equivalents and generates with healthy cash flow – some $250 million so far in 2023.

Owing to our consistently successful stock-picking in China, the country makes up a hefty chunk of our portfolio (35.7% of the fund’s assets at 29 Sept. 2023). That’s despite the grim state of the Chinese economy following the slump in its real-estate sector – and we don’t see the sector improving anytime soon. The volatility caused by China’s various economic and geopolitical crises creates attractive investment opportunities year after year. Going back to Miniso, it’s interesting to note that last year, in the midst of Beijing’s zero-Covid policy, the company’s market cap plunged to a level that was almost equal to its cash on hand, putting a zero value on its – highly lucrative – business model.

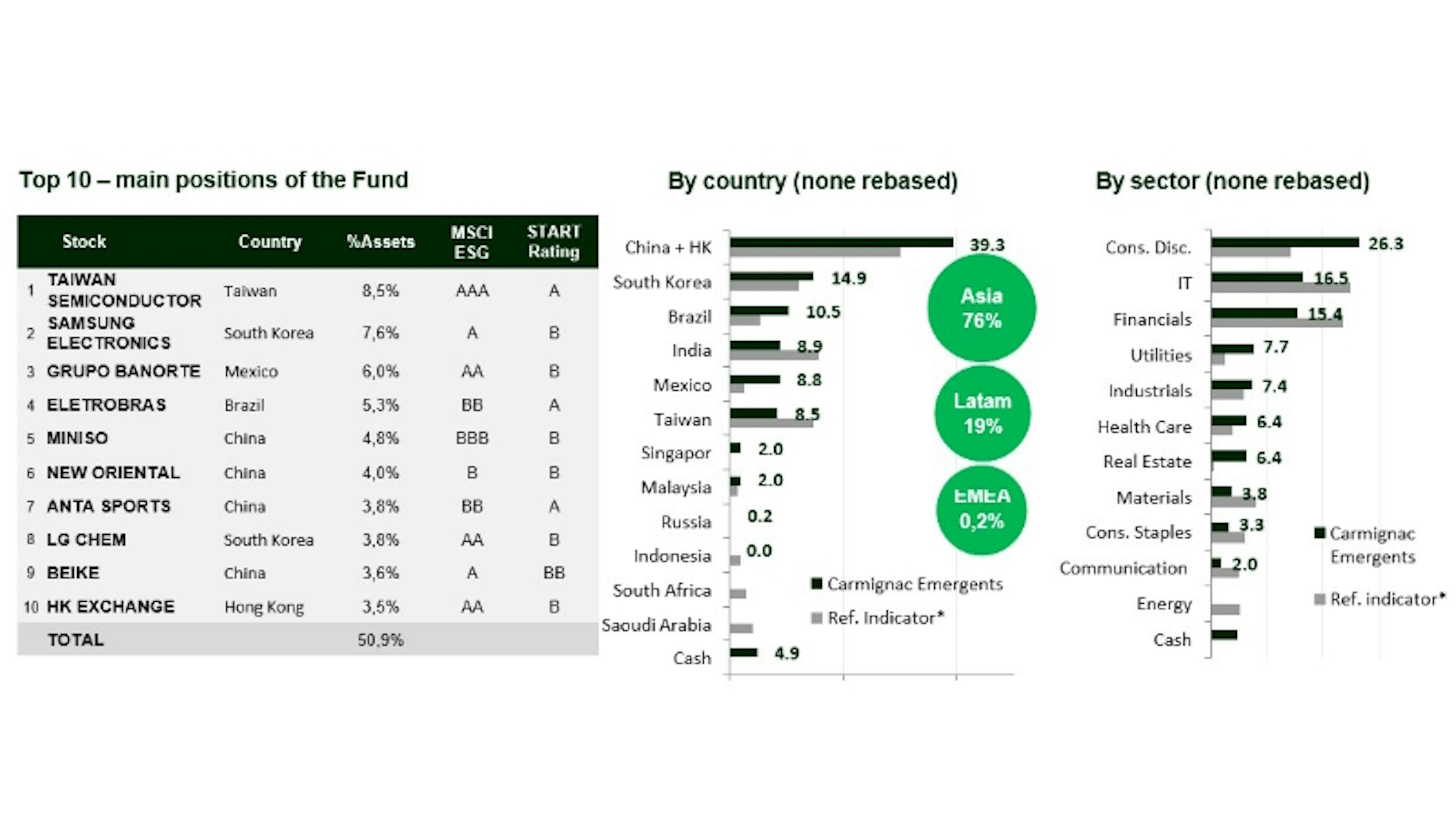

Fund Positioning as of september 29th 2023

We made few changes to our overall asset allocation in the third quarter4. Latin America still accounts for 19.3% of our portfolio (vs 8.8% for our reference indicator). We intend to keep shoring up our investments in these countries (buying on the dips) as the region stands to benefit from structural trends like the relocation of production plants to North America and economic tailwinds, such as higher commodities prices. In Mexico, we now have good visibility on the two leading candidates for the 2024 presidential election. The one favoured to win is Claudia Sheinbaum, head of the incumbent Morena party. Her campaign is based on continuing the path set by current president Lopez Obrador, who has been remarkably orthodox in his fiscal and monetary policies. The other leading candidate is Xochitl Galvez, who comes from a centre-right alliance that’s considered pro-free-market. Both contenders are fully aware that the geopolitical tensions between the US and China are throwing up major opportunities for Mexico. We’re exposed to the country through investments in domestic firms which are getting a direct boost from nearshoring by US companies.

The rest of our portfolio remains diversified with significant investments in Asia’s leading high-tech firms operating in artificial intelligence. We have moderate exposure to both India (9.0% of the fund’s assets) and Southeast Asia (4.0%). We’d like to increase our allocation to this region and therefore plan to take part in the IPOs likely to occur over the next 12 months. These flotations will give us an opportunity to invest in growth stocks operating in the region’s new economy.

*Reference indicator: MSCI EM NR (USD) dividends net dividend reinvested

China - including Hong Kong. Excluding derivative positions. Carmignac's portfolios are subject to change at any time. Data are rebased to 100% for Sector & Country positioning.

Source: Carmignac, 29/09/2023.

Socially responsible investment is central to our approach

Since its inception in 1997, Carmignac Emergents has combined what we consider our emerging-market DNA since 1989 with our commitment to strengthening our credentials in socially responsible investment (SRI). In welding together those two areas of expertise, we aim to add value for our investors while having a positive impact on society and the environment.

Classified as an Article 9 fund under the Sustainable Finance Disclosure Regulation (SFDR)5 and was awarded France’s SRI label in 2019 and Belgium’s Towards Sustainability label in 20206.

As an Article 9 Strategy under the SFDR, the Fund will invest in shares of emerging companies that have a positive outcome on environment or society and derive at least 50% of their revenues or 30% CAPEX from goods and services related to business activities which align positively with UN Sustainable Development Goals (SDGs) . This sustainable objective will be measured and monitored by the percentage of revenues aligned with the SDGs.

Our portfolio is currently structured around 4 major SRI themes that are central to our process:

As a reminder, our socially responsibility approach is based on three pillars:

- Invest selectively and with conviction, giving priority to sustainable growth themes in underpenetrated sectors and countries with sound macroeconomic fundamentals.

- Invest for positive impact, favouring companies that deliver solutions to environmental and social challenges in emerging markets and reducing our carbon intensity by at least 50% relative to the MSCI Emerging Markets Index. Our sustainable objective is: >80% Fund’s AUM invested in companies with >50% revenue or CAPEX derived from goods and services positively aligned with at least 1 of 9 targeted United Nations Sustainable Development Goals.

- Invest sustainably by consistently incorporating environmental, social and governance (ESG) criteria into our analyses and investment decision.

2Sources : Carmignac, FactSet, Alignement to UN SDGs as of 30/09/2023.

4START's proprietary ESG system combines and aggregates ESG indicators from the market's leading data providers. Due to a lack of standardization and insufficient reporting of certain ESG indicators by listed companies, it is not possible to take into consideration all relevant indicators. START provides a centralized system through which Carmignac delivers its analyses and insights on each company examined, even if the aggregated external data is incomplete. For further information, please visit our website.

5Sustainable Finance Disclosure Regulation (SFDR) 2019/2088: regulation on sustainability disclosure in the financial services sector. For more information, please visit [EUR-lex](https://eur-lex.europa.eu/eli/reg/2019/2088/oj "EUR-lex").

6Carmignac Portfolio Emergents has been awarded the French and Belgian SRI labels. https://www.lelabelisr.fr/en/ ; https://www.towardssustainability.be/ ; https://www.febelfin.be/fr.

Carmignac Portfolio Emergents

Grasping the most promising opportunities within the emerging universeDiscover the fund pageCarmignac Portfolio Emergents F EUR Acc

- Recommended minimum investment horizon

- 5 years

- Risk indicator*

- 4/7

- SFDR - Fund Classification**

- Article 9

*Risk Scale from the KID (Key Information Document). Risk 1 does not mean a risk-free investment. This indicator may change over time. **The Sustainable Finance Disclosure Regulation (SFDR) 2019/2088 is a European regulation that requires asset managers to classify their funds as either 'Article 8' funds, which promote environmental and social characteristics, 'Article 9' funds, which make sustainable investments with measurable objectives, or 'Article 6' funds, which do not necessarily have a sustainability objective. For more information please refer to https://eur-lex.europa.eu/eli/reg/2019/2088/oj.

Main risks of the fund

Fees

- Entry costs

- We do not charge an entry fee.

- Exit costs

- We do not charge an exit fee for this product.

- Management fees and other administrative or operating costs

- 1,15% of the value of your investment per year. This estimate is based on actual costs over the past year.

- Performance fees

- 20,00% when the share class overperforms the Reference indicator during the performance period. It will be payable also in case the share class has overperformed the reference indicator but had a negative performance. Underperformance is clawed back for 5 years. The actual amount will vary depending on how well your investment performs. The aggregated cost estimation above includes the average over the last 5 years, or since the product creation if it is less than 5 years.

- Transaction Cost

- 0,53% of the value of your investment per year. This is an estimate of the costs incurred when we buy and sell the investments underlying the product. The actual amount varies depending on the quantity we buy and sell.

Performance

| Carmignac Portfolio Emergents | 1.7 | 19.8 | -18.2 | 25.5 | 44.9 | -10.3 | -14.3 | 9.8 | 5.5 | 3.6 |

| Reference Indicator | 14.5 | 20.6 | -10.3 | 20.6 | 8.5 | 4.9 | -14.9 | 6.1 | 14.7 | 1.8 |

| Carmignac Portfolio Emergents | + 3.6 % | + 9.0 % | + 3.6 % |

| Reference Indicator | + 2.4 % | + 8.3 % | + 3.6 % |

Source: Carmignac at 31 Mar 2025.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor).

Reference Indicator: MSCI EM NR index

Related articles

Carmignac Portfolio Emergents: Letter from the fund manager

Naomi Waistell to join Carmignac EM equities team

Marketing communication. Please refer to the KID/KIID, prospectus of the fund before making any final investment decisions. This document is intended for professional clients.

This material may not be reproduced, in whole or in part, without prior authorisation from the Management Company. This material does not constitute a subscription offer, nor does it constitute investment advice. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice. This material has been provided to you for informational purposes only and may not be relied upon by you in evaluating the merits of investing in any securities or interests referred to herein or for any other purposes. The information contained in this material may be partial information and may be modified without prior notice. They are expressed as of the date of writing and are derived from proprietary and non-proprietary sources deemed by Carmignac to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by Carmignac, its officers, employees or agents.

Past performance is not necessarily indicative of future performance. Performances are net of fees (excluding possible entrance fees charged by the distributor). The return may increase or decrease as a result of currency fluctuations, for the shares which are not currency-hedged.

Reference to certain securities and financial instruments is for illustrative purposes to highlight stocks that are or have been included in the portfolios of funds in the Carmignac range. This is not intended to promote direct investment in those instruments, nor does it constitute investment advice. The Management Company is not subject to prohibition on trading in these instruments prior to issuing any communication. The portfolios of Carmignac funds may change without previous notice. The reference to a ranking or prize, is no guarantee of the future results of the UCIS or the manager.

Morningstar Rating™ : © Morningstar, Inc. All Rights Reserved. The information contained herein: is proprietary to Morningstar and/or its content providers; may not be copied or distributed; and is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Access to the Funds may be subject to restrictions regarding certain persons or countries. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the material or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not access this material. Taxation depends on the situation of the individual. The Funds are not registered for retail distribution in Asia, in Japan, in North America, nor are they registered in South America. Carmignac Funds are registered in Singapore as restricted foreign scheme (for professional clients only). The Funds have not been registered under the US Securities Act of 1933. The Funds may not be offered or sold, directly or indirectly, for the benefit or on behalf of a «U.S. person», according to the definition of the US Regulation S and FATCA.

The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital.

The Funds’ prospectus, KIDs, NAVs and annual reports are available at www.carmignac.com, or upon request to the Management Carmignac Portfolio refers to the sub-funds of Carmignac Portfolio SICAV, an investment company under Luxembourg law, conforming to the UCITS Directive. The French investment funds (fonds communs de placement or FCP) are common funds in contractual form conforming to the UCITS or AIFM Directive under French law.

In France, Luxembourg, Sweden: The risks, fees and ongoing charges are described in the KID (Key Information Document). The KID must be made available to the subscriber prior to subscription. The subscriber must read the KID. Investors may lose some or all their capital, as the capital in the funds are not guaranteed. The Funds present a risk of loss of capital. The Funds’ prospectus, KIDs, NAV and annual reports are available at www.carmignac.com, or upon request to the Management.

In the United Kingdom: the Funds’ respective prospectuses, KIIDs and annual reports are available at www.carmignac.co.uk, or upon request to the Management Company, or for the French Funds, at the offices of the Facilities Agent at BNP PARIBAS SECURITIES SERVICES, operating through its branch in London: 55 Moorgate, London EC2R. This document was prepared by Carmignac Gestion, Carmignac Gestion Luxembourg or Carmignac UK Ltd. FP Carmignac ICVC (the “Company”) is an Investment Company with variable capital incorporated in England and Wales under registered number 839620 and is authorised by the FCA with effect from 4 April 2019 and launched on 15 May 2019. FundRock Partners Limited is the Authorised Corporate Director (the “ACD”) of the Company and is authorised and regulated by the FCA. Registered Office: Hamilton Centre, Rodney Way, Chelmsford, Essex, CM1 3BY, UK; Registered in England and Wales with number 4162989. Carmignac Gestion Luxembourg SA has been appointed as the Investment Manager and distributor in respect of the Company. Carmignac UK Ltd (Registered in England and Wales with number 14162894) has been appointed as a sub-Investment Manager of the Company and is authorised and regulated by the Financial Conduct Authority with FRN:984288.

In Switzerland: the prospectus, KIDs and annual report are available at www.carmignac.ch, or through our representative in Switzerland, CACEIS (Switzerland), S.A., Route de Signy 35, CH-1260 Nyon. The paying agent is CACEIS Bank, Montrouge, Nyon Branch / Switzerland, Route de Signy 35, 1260 Nyon.

In Spain : The Funds are registered with the Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores) under the following numbers: Carmignac Sécurité 395, Carmignac Portfolio 392, Carmignac Patrimoine 386, Carmignac Absolute Return Europe 398, Carmignac Investissement 385, Carmignac Emergents 387, Carmignac Credit 2027 2098, Carmignac Credit 2029 2203, Carmignac Credit 2031 2297, Carmignac Court Terme 1111.

The Management Company can cease promotion in your country anytime.

Investors have access to a summary of their rights in English on the following links: UK ; Switzerland ; France ; Luxembourg ; Sweden.